In the year 2021 the Florida real estate market experienced a very rapid, high, and unexpected price increase of the Real Estate.

This fast and intense change made some market players think that Florida was in the center of a speculative bubble.

Historical average property values and annual increases were far outstripped by the new prices, and buyers were willing to pay much higher prices than just a few months earlier in order to purchase a property, probably partly out of concern that prices might rise further.

Well, what happened in the Florida market, while seeming like a classic example of a speculative bubble, is actually an adjustment due to unique and unprecedented external factors and probably has nothing (or very little) to do with mere speculation.

The primary external factor driving this growth was the pandemic. In the United States, word soon spread that Florida was not suffering too much from the effects of Covid-19, that the lockdown was all in all bearable, businesses open, restrictions less severe. Add to that, the favorable climate and the presence of many properties with open spaces helped, and the thought of having to be in quarantine was certainly more bearable, imagining themself in a home with a garden in the sunny State.

So there was a huge flow of people from North America moving to Florida NOT for speculation but for a better quality of life and safety, for them and their families; these people moved their businesses and enrolled their children in school, and at some point they needed the home.

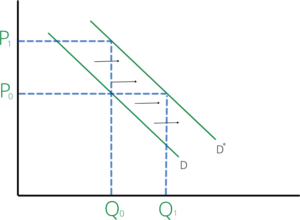

This resulted in not simply an increase in demand, but a shift in the demand curve, which then created a totally different market scenario than before.

Such a situation, although unique and unpredictable, makes us think that in the evaluation of the market conditions, it is never wise to consider single isolated elements, rather having to consider a social and general context to the dynamics of prices, trying to have objective data available and as accurate as possible.