The current recession is also being felt in the Miami area but the real estate market is solid. According to data provided by the Miami Association of Realtors, it’s possible to see that the Miami real estate market has undergone a significant decrease in terms of homes sold and listing properties since last August, but on the other hand, it has instead experienced an increase in overall sales prices. In fact, comparing the state of the market in August of this year with that of last August 2021, the Miami real estate market has seen a change in terms of supply and demand.

By analyzing the data we can see how it has changed:

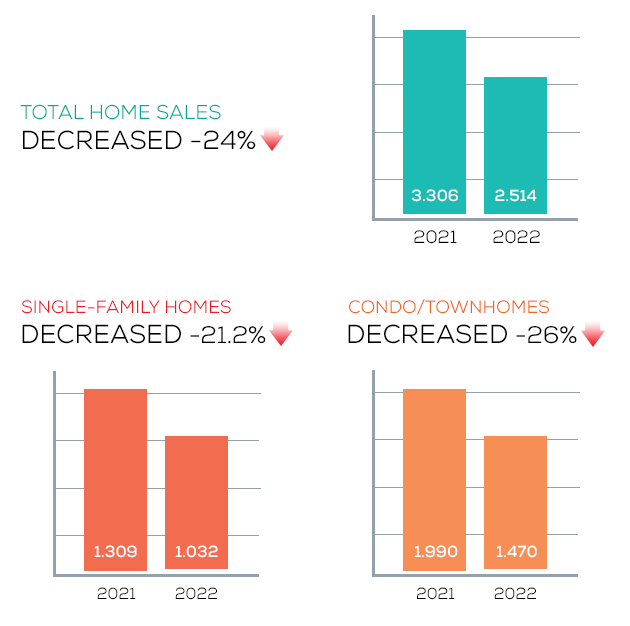

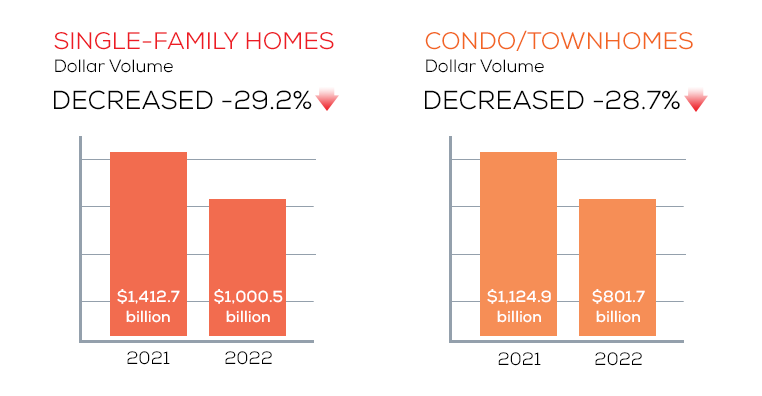

The number of home sales in 2021 was 3,306, compared to 2,541 this year. This is, therefore, a decrease of 24% for this type of sale. Since last August the single-family market specifically, has recorded a decline in sales equal to 21.2%, this means that the volume in dollars has gone from 1.4 billion dollars of transactions recorded in August 2021, to 1 billion dollars in 2022. This means that the total volume in dollars decreased by 29.2%.

Analyzing the data relating to the Condo/Townhomes the decrease in transactions is 26%. In 2021 the transactions concluded to have approached 2,000, this year instead they stopped at 1,470. With this difference, the volume in dollars reflects a decrease of 28.7%: in 2021 the total amount of dollars was 1.1 billion, while this year’s average is around 802 billion.

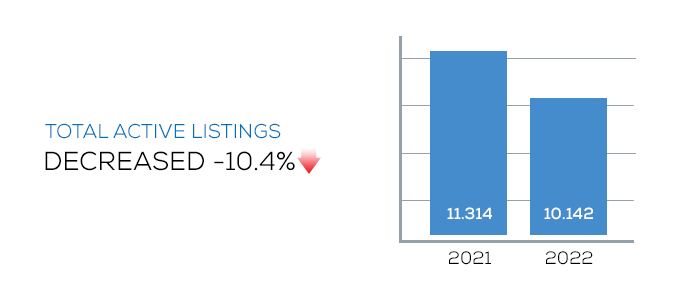

Migratory flows that have been affecting Florida in the last period are a primary factor in the influence of the real estate market. More and more people are considering Miami as an opportunity both for their investments and as a future home, and this is reflected in the change in the inventory of properties since 2021. Active listings in the Miami real estate market have decreased by 10.4% with a consequent lowering of choice. Thanks to the graph it is possible to see how, compared to August 2021, active listings have gone from 11,314 to just over 10 thousand.

However, if we analyze the average price of the properties and listings there is an increase compared to the previous year, both for the single-family houses and the condos. The average price of the single-family home has increased by 10.1% with a value that stands at $ 551,250 more than in 2021. The same thing can also be said for apartments, where the price has risen. 11.9% with a dollar value of 375,000 more.

What may apparently seem like a contradiction, actually reveals one of the main characteristics of the Miami real estate market (and of the most important American metropolitan areas). Normally, a contraction in the volume of business and an extension of the sales times should also correspond to a lowering of prices. In the case of Miami (like New York and other major urban areas), the downturn in business does not necessarily mean a drop in prices, much less a collapse of the market, and this is due to a number of factors that give stability to the market, including the type of owners (not only pure investors but real users of the assets), the solidity of the underlying economic fabric, and the allocation of wealth in well-defined areas. A similar phenomenon was seen during the pandemic and before the arrival of vaccines, when a situation of total uncertainty caused the market to freeze, with a very low number of transactions, yet relatively stable prices.

The American real estate market, therefore, proves to be stable and remains a great investment, especially in the dynamic and thriving economies of large urban metropolises.